Heading into NADA, I wondered how dealers would respond when they saw their used vehicle pricing presented to them through the investment-based lens that ProfitTime GPS provides.

My curiosity came from the fact that I knew every dealer who saw their pricing in ProfitTime GPS’ pricing profile would see exactly the same thing—an irrational inversion of used vehicle pricing that is causing them to sell fewer used vehicles, and make less money, than they should be achieving.

The response was as I expected. When faced with a true picture of their used vehicle pricing, and how it relates to each vehicle’s investment value, dealers had a wake-up moment. Most, if not all, were unaware the inversion existed. Many believed they were pricing their used vehicles in a more rational, investment-minded way.

Unfortunately, the used vehicle pricing irrationality is nothing new. Neither is its universal nature. I’ve been telling dealers across the country about the irrational pricing problem for more than two years, a time when my message got lost as dealer-positive market conditions masked the damage it causes.

But that’s not the case today, and the experience at  NADA affirms my belief that every dealer in the country who hasn’t invested the effort and time to eliminate the irrationality in their used vehicle pricing suffers from it today, whether they know it or not. That includes most, if not all, of you reading this post.

NADA affirms my belief that every dealer in the country who hasn’t invested the effort and time to eliminate the irrationality in their used vehicle pricing suffers from it today, whether they know it or not. That includes most, if not all, of you reading this post.

A Closer Look at the Irrationality

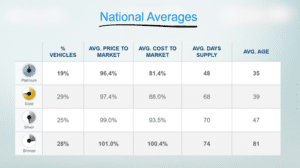

The irrationality surfaces when dealers view your inventory through ProfitTime GPS’ used vehicle pricing profile. The profile shows a dealer’s used vehicles categorized by the investment values (Platinum, Gold, Silver and Bronze) the system identifies for each vehicle. The profile also shows the average Cost to Market and Price to Market percentages, along with the average age of vehicles and share of inventory, for each investment value bucket.

The chart at right reveals a representative example of what every dealer sees when their inventory appears for the first time in ProfitTime GPS. The chart shows two disturbing take-aways:

Take-Away 1: As dealers, you are most proud of their worst used vehicle investments. You can see this reality by looking at the Bronze vehicles on the chart. Note: ProfitTime GPS classifies vehicles as “Bronze” because they typically have the highest Cost to Market and like-mine Market Days Supply and the least retail sales volume. The ProfitTime GPS system measures and weighs these variables for each vehicle, deriving an investment value designation.

On the chart, you can see that Bronze vehicles make up the largest share of inventory, and the vehicles have the highest average Cost to Market (100.4 percent), Price to Market (101 percent) and days in inventory (81 days) compared to vehicles in other investment segments. The upshot: You are pricing your Bronze vehicles above the current market, and they aren’t selling as quickly as they should, given their high risk/low return investment profile.

Take-Away 2: As dealers, you are cheap-selling your best used vehicle investments. Look at the Platinum vehicles, or the units ProfitTime GPS identifies as the ones with the highest ROI and profit potential. You can see the Platinum vehicles have the lowest Cost to Market (81.4 percent), Price to Market (96.4 percent) and days in inventory (35) than all the other vehicles. The upshot: You are leaving money on the table by selling your best investments for too little money too quickly.

Reasons for the Irrationality

You may be thinking: That’s not how my inventory looks. We heard the same sentiment at NADA. And, to be sure, some dealers didn’t like hearing this news. In fact, they questioned the profile’s accuracy, and ProfitTime GPS’ ability to know each vehicle’s inherent investment value.

Such concerns typically fade when you take a closer look at specific vehicles in the Bronze and Platinum buckets.

With the Bronze units, you’ll likely remember the reasons the vehicles were investment-distressed. You either paid too much money to acquire them, or the market changed, and cars you might have purchased right, and then priced too high, became problematic. With the Platinum units, you’ll have cars that you don’t feel comfortable pricing higher because they won’t get VDPs, or you’re worried that if they don’t sell fast, you’ll miss your volume goals for the used vehicle department.

But it’s not hard to understand the whys behind the used vehicle pricing inversion and irrationality. With the Bronze cars, you don’t want to take the hit on a vehicle that you probably knew, at least on some level, wouldn’t produce the gross profit you expected or wanted to see when you acquired it. Hence, the vehicle’s priced high to give it a shot to make gross. With the Platinum vehicles, your pricing reflects two things—the need to drive overall volume due to Bronze vehicles that aren’t selling, and the desire among your sales team to sell and turn vehicles that offer them the best money-making opportunities.

My question to every dealer who hasn’t yet addressed their own used vehicle pricing irrationality is this: Are you OK with what you see here?

I haven’t yet met a dealer who’s OK with the used vehicle pricing irrationality once they become aware of it. I also haven’t met a dealer who, after they’ve univerted their pricing and begun pricing each vehicle in accord to its investment value, doesn’t appreciate the superior outcomes of higher volume and average gross profit this more rational approach produces.

The post A Universal Used Vehicle Problem—Inverted, Irrational Pricing appeared first on Dale Pollak.